Want to earn passive income effortlessly? Cashback apps make it simple to save money on everyday purchases like groceries, gas, and online shopping. Here's a quick rundown of the best cashback apps and how they can help you earn extra cash:

- Rakuten: Earn 1%–40% cashback at 3,500+ stores. Automated browser extension and quarterly payouts via PayPal, checks, or gift cards.

- Ibotta: Perfect for groceries. Link loyalty accounts or scan receipts to earn $20–$300 monthly. Cash out at $20 via PayPal, bank transfer, or gift cards.

- Fetch Rewards: Scan any receipt to earn points (1,000 points = $1). Redeem for gift cards with a low $3 threshold.

- Upside: Ideal for gas and dining. Earn up to $0.25 per gallon and 30% at grocery stores. Cash out starting at $1.

- Checkout 51: Weekly grocery and gas deals with a $20 cashout threshold via PayPal or check.

- Capital One Shopping: Browser extension finds coupons and offers gift card rewards.

- Honey: Automatically applies coupon codes and offers PayPal Rewards points (1,000 points = $10).

Quick Comparison

| App | Best For | Cashback Rates | Automation | Redemption Options | Minimum Payout |

|---|---|---|---|---|---|

| Rakuten | Online shopping | 1%–40% | High (browser extension) | PayPal, check, gift cards | $5 |

| Ibotta | Groceries | Varies by offer | Medium (loyalty linking) | Bank transfer, PayPal, gift cards | $20 |

| Fetch Rewards | Any receipt | Points system | Low (receipt scanning) | Gift cards, donations | $3 |

| Upside | Gas, dining | Up to 30% | High (linked cards) | Bank transfer, PayPal, gift cards | $1 |

| Checkout 51 | Groceries, gas | Varies by offer | Low (receipt scanning) | PayPal, check | $20 |

| Capital One | Online shopping | Varies | High (browser extension) | Gift cards | None |

| Honey | Online shopping | 1%–5% | High (browser extension) | PayPal, gift cards | 1,000 points ($10) |

Maximize your savings: Combine apps like Rakuten for online shopping, Ibotta for groceries, and Upside for gas. These tools can turn your routine spending into passive income with minimal effort.

10 Best Cashback Apps in 2025 - Save Money by Earning Rewards (Tested Sites)

1. Rakuten

Since its launch in 1999, Rakuten has paid out over $3.6 billion in cashback to 21 million members, partnering with more than 3,500 stores to make saving money easier.

Cashback Rates and Offers

Rakuten offers cashback rates ranging from 1% to 40%, depending on the retailer. For example, you can earn 3% cashback at stores like Ulta Beauty and JCPenney, 2.5% at GameStop, and 1.5% at Nike. However, Walmart’s 1% cashback excludes certain categories like furniture, health products, camping gear, and Apple products.

To sweeten the deal, Rakuten runs double cashback promotions, allowing you to earn even more at participating stores during these periods. New users can take advantage of a welcome bonus to start earning right away, and the platform also provides discount codes for select retailers to maximize your savings. One downside: purchases made on Amazon don’t qualify for cashback at this time.

"Marketers need to start thinking about retail sales events the same way they used to think about Memorial Day sales or Presidents Day sales. These retail moments provide marketers an opportunity to engage with shoppers at times throughout the year when they're most active and are intent on spending. By investing strategically in retail sales events throughout the calendar year, brands can easily create and maintain consumer loyalty."

– Kristen Gall, Rakuten President and retail expert

Automation Level (Passive Mechanics)

Rakuten makes earning cashback almost effortless after the initial setup. Its browser extension automatically detects cashback opportunities as you shop online and sends notifications when deals are available. To get started, install the Rakuten browser extension or mobile app, link your PayPal account, and you're good to go. Once you activate an offer through the extension or app, cashback is added to your account automatically.

Redemption Methods and Thresholds

Cashback is processed quarterly, and you only need a minimum of $5 to redeem your earnings. Redemption options include PayPal, checks, Amex Membership Rewards Points, or gift cards. Rakuten also lets you send your cashback to friends, family, or even donate it to charities. This flexibility makes it easy to make the most of your earnings while integrating cashback into your everyday spending.

Features and Benefits

Rakuten goes beyond basic cashback by offering promo codes and coupons to stack extra savings on top of your earnings. The platform works across a variety of spending categories, including retail stores, restaurants, and even travel bookings, giving you plenty of ways to save.

The numbers speak for themselves: in 2024, the average cashback per member was $101.46, compared to $90.16 in 2023. During Rakuten's Big Give Week in 2022, the platform saw a 133% jump in visits and a 188% increase in first-time buyers, proving its growing popularity among shoppers. Next, dive into how other cashback apps are making passive income even simpler.

2. Ibotta

Since its debut, Ibotta has paid out an impressive $2.3 billion in cashback to users shopping at more than 3,000 retailers. This places it among the top players in the grocery cashback scene. The app turns everyday purchases - like groceries, gas, and dining - into easy savings, making it a go-to option for many.

Cashback Rates and Offers

Ibotta’s cashback model is straightforward, offering fixed amounts ranging from $0.20 to $5.00 per qualifying purchase. With partnerships spanning over 2,000 retail chains - including grocery stores, restaurants, movie theaters, convenience stores, and pet stores - there’s no shortage of opportunities to save. On average, users earn about $20 per month, but those who use the app consistently for their regular shopping can rake in over $1,000 annually. Plus, Ibotta’s referral program adds an extra incentive: both you and your friend receive $5 when they sign up and earn their first cashback.

Automation Level (Passive Mechanics)

Ibotta makes saving money even easier with its automation features. By linking store loyalty accounts, the app can automatically match your purchases with available offers, eliminating the hassle of manually uploading receipts. For online shopping, the Ibotta browser extension provides automatic notifications when cashback deals are available, so you can activate offers before making a purchase. As of March 2025, Clark.com highlighted a handy feature for Walmart shoppers: you can link your Walmart account directly through the browser extension, allowing Ibotta to track eligible purchases without requiring receipt scans.

Redemption Methods and Thresholds

To cash out your earnings, Ibotta requires a $20 minimum - slightly higher than some competitors, but reasonable given the app’s earning potential. Once you hit this threshold, you can choose from several redemption options, including bank transfers, PayPal deposits, or digital gift cards. Bank and PayPal transfers typically take 1–3 business days to process, while gift cards are delivered via email within 24 hours. On average, users earn around $260 annually in cashback, and the app maintains high user satisfaction with a 4.8-star rating on the Apple App Store and a 4.6-star rating on Google Play.

Features and Benefits

What truly sets Ibotta apart is its focus on real cash instead of confusing points systems. The app’s intuitive interface makes it easy to browse offers by category or search for specific brands you frequently buy.

"I love finding ways to save money when shopping, and sometimes, there just aren't enough coupons to feel like I'm saving. That's why I love apps like Ibotta, which pay you cash back just for shopping for items you'd normally purchase." – FinanceBuzz

Ibotta shines as a grocery cashback app, especially for families who spend heavily on household essentials. That said, some users have reported occasional glitches, such as disappearing offers or issues with receipt scanning. Linking loyalty accounts is often the more reliable way to ensure you earn cashback seamlessly.

3. Fetch Rewards

Fetch Rewards makes earning cashback straightforward - just scan any receipt to rack up points. With over 11 million weekly users and more than 5 billion receipts scanned, the app has awarded over $910 million in rewards since its inception. There’s no need to activate offers in advance, and you can shop at any store to start earning.

Cashback Rates and Offers

Fetch operates on a points-based system where 1,000 points equal $1 in redemption value. Every receipt you scan earns at least 25 points, no matter where you shopped or what you purchased. This guaranteed earning structure sets it apart from apps that require specific purchases.

You can earn even more through bonus offers. Depending on the product or retailer, qualifying purchases can earn anywhere from 250 to 3,000 points. For example, active users who scan an average of 28 receipts per month can accumulate about 10,000 points monthly, which translates to approximately $120 annually.

Fetch also boasts partnerships with major brands and unique deals. A standout example is the GoodRx partnership, which awards 10,000 points ($10) when you use a GoodRx coupon for prescriptions. Their referral program is another way to boost earnings - invite a friend, and you’ll earn 1,000 points, while they’ll receive 500 points after scanning their first receipt.

Automation Level (Passive Mechanics)

While Fetch does require receipt scanning, it simplifies the process with automatic e-receipt collection. By linking your email and Amazon accounts, the app can automatically gather digital receipts, saving you time. Additional perks include bonus offers through partnerships like Huggies Rewards+ and General Mills Good Rewards. You can also join clubs like PepsiCo Tasty Rewards for extra earning opportunities.

Want more ways to earn? The Fetch Play feature lets you accumulate points by playing games. On average, users earn 3,000 points weekly through this feature alone.

Redemption Methods and Thresholds

Fetch Rewards offers one of the lowest cashout thresholds in the cashback world - just 3,000 points ($3). Redemption options include gift cards, Visa cash cards, sweepstakes entries, and even donations to your favorite charities. Popular choices include:

- $5 Amazon gift card: 6,500 points

- $5 Target gift card: 5,000 points

- $10 Visa Cash Card: 9,500 points

Once you redeem, rewards typically process within 72 hours. Plus, there’s no limit on how often you can cash out as long as you meet the minimum threshold.

Features and Benefits

Fetch Rewards stands out for its simplicity and flexibility. There’s no need to pre-select deals or activate offers before shopping. Just scan your receipts within 14 days of purchase, and the app takes care of the rest.

"Fetch Rewards offers a simple solution to this problem by paying users at least 25 points for any receipt. I love the flexibility of the app, and the fact that I can upload old receipts (up to 14 days) and still get rewards." – FinanceBuzz

The app’s popularity is reflected in its stellar ratings: 4.8/5 stars on the Apple App Store (4.8 million reviews), 4.6/5 stars on Google Play (1 million reviews), and 4.7/5 stars on TrustPilot (1,700 reviews). Users praise its responsive customer support and straightforward earning system.

However, keep in mind that accounts with no activity - earning or redeeming - for 90 days are considered inactive, which can result in point expiration.

"Out of all the cashback apps we've reviewed, Fetch ranks among the best with its user-friendly app flow, solid cashback rates, and various ways to earn. With this in mind, it's certainly worth signing up for." – Grace Lemire, Think Save Retire

Up next, we’ll look at another app that makes earning cashback just as effortless.

4. Upside

Upside focuses on everyday purchases - like gas, groceries, and dining - helping you earn cashback on the things you buy regularly. With over 100,000 locations nationwide participating, this app turns your routine spending into a steady stream of rewards through personalized offers. Let’s break down what makes Upside a standout option for cashback.

Cashback Rates and Offers

Upside provides impressive cashback opportunities. You could earn up to 25¢ per gallon on gas, 45% back at restaurants, and 30% back at grocery stores. On average, users see about 10¢ per gallon on gas, 8% back at restaurants, 5% back at grocery stores, and 12% back at convenience stores. For frequent users, this adds up to an average of $290 annually - just from regular spending.

Automation Level (Passive Mechanics)

The app makes earning cashback easy with its automated tracking system. By using partner data, Upside verifies transactions without requiring you to upload receipts manually. Its "Check In" feature simplifies the process even further. Link your credit or debit card, and the app takes care of the rest, making it a truly hands-off experience.

Thanks to improvements in machine learning, Upside has optimized how users sign up and claim offers. So far, the app has distributed over $800 million in cashback.

Redemption Methods and Thresholds

Upside offers flexible ways to cash out your rewards. You can choose direct bank transfers, PayPal, or digital gift cards. The minimum payout thresholds are $1 for bank transfers and PayPal, while gift cards generally require at least $10. Keep in mind, a $1 fee applies to bank transfers under $10 and PayPal transfers under $15. The best part? Your cashback never expires.

Features and Benefits

Upside uses machine learning to tailor offers based on your shopping habits and location. Plus, it allows you to stack its rewards with credit card points or other discounts, giving you even more savings. The referral program is another perk - you’ll earn $7 for each friend who signs up, and you’ll get an extra 1¢ per gallon on fuel purchases.

For the best results, check the app regularly for local deals and make sure to follow any offer requirements to qualify for the advertised rates.

sbb-itb-fd652cc

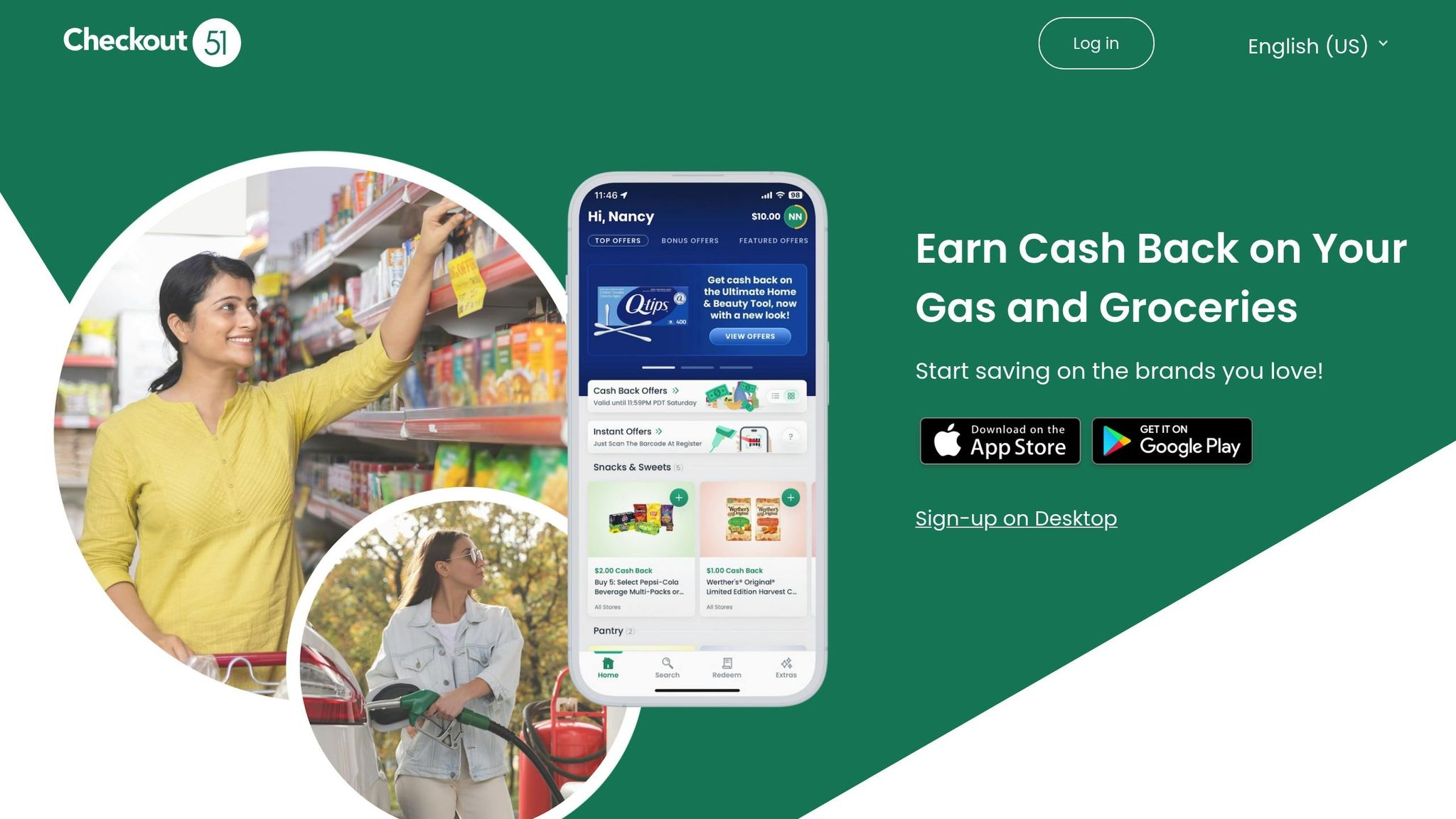

5. Checkout 51

Checkout 51 is all about helping you save on everyday essentials like groceries and gas. Unlike Upside's fully automated rewards, this app combines manual receipt scanning with smart notifications for location-based deals. New offers are released every Thursday, giving you fresh opportunities to earn cashback on your routine purchases.

Cashback Rates and Offers

With Checkout 51, you can earn up to 25¢ per gallon on gas purchases. Grocery rebates focus on staples like eggs, bread, milk, and fruit, with weekly deals updated regularly. As of June 2024, the app featured over 34 in-store offers spanning groceries, personal care items, home essentials, health products, medicine, and pet supplies. For online shoppers, there were 18 cashback offers, including up to 25.5% cashback for new Uber Eats customers and $6.30 cashback on Uber rides.

Automation Level (Passive Mechanics)

While Checkout 51 automates some features, it's not entirely hands-free. For online purchases, you can shop directly through the app to earn cashback without needing to upload receipts. The app's location-sharing feature sends you instant notifications when you're near participating stores, making it easier to snag rewards. However, most in-store earnings still require you to upload receipts manually. Active users typically earn between $5 and $10 per month, though the app also offers surveys as an extra way to boost your earnings.

Redemption Methods and Thresholds

To cash out, you need to hit a $20 minimum balance. Once you reach that threshold, you can choose between a PayPal transfer or a mailed check. PayPal transfers usually take 5 to 15 business days, while checks can take anywhere from 15 to 30 business days to arrive. The app is also experimenting with PayPal cash rewards for select users, though options remain somewhat limited.

Features and Benefits

One standout feature of Checkout 51 is its generic rebates, which aren't tied to specific retailers. This flexibility means you can shop at your favorite stores without having to change your habits to earn cashback. The app is well-received by users, boasting a 4.0-star rating on the App Store from 6,300 reviews and a 4.2-star rating on Google Play from 78,800 reviews. New deals go live every Thursday at midnight and expire the following Wednesday night, so it’s worth enabling location sharing and checking the app weekly for fresh offers. Whether you shop at a big chain or a local store, Checkout 51 keeps things simple and rewarding.

6. Capital One Shopping

Capital One Shopping is all about making online shopping easier while helping you save money and earn rewards. This free browser extension and mobile app works behind the scenes to find coupon codes, compare prices, and deliver deals tailored to your shopping habits. With access to discounts at over 100,000 online stores, it’s designed to help you cut costs on your everyday purchases.

Cashback Rates and Offers

Unlike traditional cashback platforms, Capital One Shopping offers personalized rewards that change depending on the retailer and timing. You’ll often receive emails featuring boosted reward rates, and you can always check the "Your Personalized Deals" section on their website for current offers. For example, users have earned $36 on a $299 Bose purchase, $125 on a $416 Banana Republic order, and saved $213 using a 40% off coupon on a $533 FragranceNet purchase. Over the past year, users collectively saved more than $800 million through the platform.

Automation Level (Passive Mechanics)

Once you’ve installed the extension, Capital One Shopping takes care of the hard work. As you browse and shop online, it automatically searches for coupon codes and compares prices to ensure you get the best deal. Small pop-ups may appear to notify you of better deals or to test alternative coupon codes, and in some cases, the extension applies codes for you. It even activates available offers as you shop, keeping the process smooth and hassle-free.

Redemption Methods and Thresholds

Redeeming rewards is straightforward and flexible. Depending on your account type, you can use rewards for gift cards at popular retailers. If you’re a Capital One credit cardholder, you might also have the option to redeem rewards as statement credits, miles, or cash back. Online shopping rewards usually show up as pending in your Rewards & Savings Dashboard within a few days, while travel-related rewards take 60–90 days to process. Statement credits can take up to three billing cycles to post, and if you hold multiple Capital One credit cards, the credit may be applied to any active card in good standing.

Features and Benefits

Capital One Shopping stands out for its compatibility with a wide range of online retailers and its high ratings - 4.9 on the App Store and 4.7 on Google Play. The platform also offers a universal product search feature on its website, which helps you compare prices across multiple stores. One user shared their two-year experience with the app, during which they saved $1,484.27 and earned rewards across 60 online purchases. To get the most out of Capital One Shopping, make sure to check their emails for boosted rewards and use the price comparison tool whenever you shop online.

7. Honey

Honey makes saving money effortless by automatically applying coupon codes and offering a rewards program that turns points into cash. With over 17 million members worldwide and compatibility with more than 30,000 retailers, it’s one of the most versatile shopping tools out there. Let’s dive into how Honey’s automation and rewards program help streamline your savings [58,59].

Cashback Rates and Offers

Honey’s rewards program, previously known as Honey Gold and now called PayPal Rewards, operates on a points-based system. You can earn rewards ranging from 1% to 5%, with every 1,000 points equaling $10 [58,66]. On average, Honey users save $126 annually, enjoying discounts of about 17.92% per transaction, according to the company’s data.

Automation Level (Passive Mechanics)

The Honey browser extension does the heavy lifting for you. It automatically applies coupon codes at checkout and includes tools like Droplist and Amazon Badge to track price drops and secure better deals [60,61].

Redemption Methods and Thresholds

Honey Gold points can be redeemed in several ways: as cash through PayPal, gift cards, or even donations. For U.S. users, the minimum threshold for redeeming gift cards is 1,000 points. To cash out rewards, ensure your Honey and PayPal accounts share the same email address [63,64]. You can also use points directly during PayPal checkout for eligible purchases or deposit cash rewards into a PayPal Savings account [63,65]. Keep in mind, all redemptions are final, and there are no fees involved [60,65].

Features and Benefits

Honey’s browser extension works seamlessly across tens of thousands of online stores, ensuring you never miss out on savings. Its automated coupon application removes the hassle of searching for deals, while tools like the Droplist and Amazon Badge help you time your purchases for the best prices. To keep your account active, you’ll need to earn at least 10 points annually. If you’re using PayPal integration, staying active requires either earning 10 points or completing three eligible PayPal transactions within the same year.

While Honey might not offer the highest cashback rates, its combination of automated savings features and easy-to-use rewards makes it a go-to choice for shoppers looking for convenience in their savings routine.

App Comparison Chart

Choosing the best cashback app depends on how you shop, how you prefer to redeem rewards, and how much effort you're willing to put into earning. Here's a quick breakdown of some of the top cashback apps and how they stack up in key areas:

| App | Cashback Rates | Automation Level | Redemption Options | Key Strengths |

|---|---|---|---|---|

| Rakuten | 1% to 40% | High – Browser extension and linked cards | PayPal, check, gift cards | Extensive retailer network with automatic price comparisons |

| Ibotta | Varies by offer | Medium – Loyalty account linking | Bank transfer, PayPal, gift cards | Great for grocery shopping with receipt-free options |

| Fetch Rewards | Points-based system | Low – Receipt scanning required | Gift cards, cash sweepstakes, donations | Accepts any receipt and partners with major brands |

| Upside | Up to 25¢ per gallon for gas; 25% on dining | High – Linked debit cards | Bank transfer, PayPal, gift cards | Specialized in gas rewards; users report $270–$340 in yearly earnings |

| Checkout 51 | Varies by offer | Low – Receipt scanning | PayPal, check | Rotating offers with a focus on groceries |

| Capital One Shopping | Varies by retailer | High – Browser extension | Gift cards only | Automatic coupon testing and price tracking |

This table highlights each app's strengths, making it easier to choose the right fit - or combine multiple apps for maximum savings. Here's a closer look at how these apps differ:

Top Cashback Rates: Rakuten leads with cashback rates as high as 40% for select retailers, while Upside shines in specific categories like gas and dining.

Best for Automation: Rakuten, Capital One Shopping, and Upside make saving simple by using browser extensions or linked cards, eliminating the need for manual input.

Flexible Redemption Options: Most apps offer a variety of payout methods, such as PayPal, bank transfers, and gift cards. However, Capital One Shopping is limited to gift card rewards.

Welcome Bonuses: Rakuten offers a $30 bonus after your first qualifying purchase, while new Ibotta users can earn up to $20 in bonuses.

Earning Potential: Your annual earnings depend on your spending habits. Upside users, for example, report earning between $270 and $340 a year, primarily through gas and dining purchases.

User Experience: Rakuten and Ibotta consistently earn high marks, with average ratings of 4.8/5 on the App Store. Capital One Shopping edges ahead with a 4.9/5 rating, thanks to its automatic coupon code testing feature. That said, Rakuten users occasionally mention payment delays, while some Ibotta users report issues with offer availability or receipt scanning.

For the best results, consider using a combination of apps to cover all your spending categories. For instance, you could rely on Rakuten and Capital One Shopping for online purchases, use Upside for gas and dining, and turn to Ibotta for groceries. By mixing and matching, you can maximize your cashback without adding much effort.

Conclusion

Cashback apps make it easy to earn extra money on purchases you’re already planning to make. Rakuten is a standout for general shopping, Ibotta shines for grocery savings, and Upside is a strong pick for fuel purchases, with users reporting yearly earnings between $270 and $340.

To get the most out of these apps, consider using multiple automated options together. Apps like Rakuten, Capital One Shopping, and Upside work in the background, earning rewards without requiring much effort - an appealing solution for the 90% of consumers looking for cashback rewards as a way to manage rising costs. This multi-app strategy can effortlessly fit into your daily spending routine.

For a well-rounded approach, use Rakuten for online shopping, Upside for gas, and Ibotta for groceries. This combination covers key spending areas without overlap. Pair these apps with a rewards credit card, and you’ll create multiple layers of cashback for every purchase.

Focus on apps that automate the process, like Rakuten’s browser extension or Upside’s linked debit card. With these tools, cashback can become a consistent and hassle-free way to supplement your income as you go about your regular spending.

For more ideas on passive income, check out e-SideHustles (https://esidehustles.com). They offer a collection of resources to help you explore other opportunities and diversify your earnings beyond cashback apps.

FAQs

What’s the best way to maximize cashback earnings by using multiple apps?

To maximize your earnings with cashback apps, consider reward stacking. This strategy involves layering cashback offers from multiple apps and even your credit card on a single purchase. For instance, many cashback platforms allow you to upload the same receipt without any issues, meaning you can collect rewards from each app simultaneously.

Keeping things organized is key. Track your purchases and monitor active cashback deals to ensure you don’t miss out. Setting reminders for time-sensitive promotions can also help you snag extra savings. With a little planning, you can turn your regular spending into a more rewarding experience, boosting your passive income along the way.

How can you redeem cashback rewards with the apps mentioned?

Cashback apps provide a range of ways to redeem your rewards, catering to different preferences. Take apps like Ibotta and Rakuten, for instance - they let you cash out through direct bank deposits, PayPal, or gift cards, offering plenty of flexibility. Similarly, Fetch Rewards allows you to convert your points into either gift cards or cash via PayPal. On the other hand, Dosh keeps things even simpler by automatically transferring your cashback to your linked bank account.

With these varied redemption options, you can pick what suits you best - whether that's cash in your pocket or gift cards for your go-to stores.

Are there any restrictions when earning cashback on purchases from stores like Amazon or Walmart?

Cashback apps often come with specific restrictions, especially when shopping at major retailers like Amazon and Walmart. For example, purchases made with gift cards typically don’t qualify for cashback, and fees like taxes or shipping costs are usually excluded. Some apps or retailers also limit cashback to certain product categories.

At Walmart, most purchases are eligible for cashback, but there might be limits, such as a cap of $100 per transaction when using a debit card. It’s always a good idea to review the app’s terms or the retailer’s policies to understand any exclusions or restrictions before you shop.