Passive income apps make it easy to earn money with minimal effort. Whether you're shopping, investing, or renting out your property, these apps help you generate extra income while saving time. Here's a quick overview of 20 apps you can try today:

- Swagbucks: Earn points for surveys, shopping, and more. Redeem for PayPal cash or gift cards.

- Honeygain: Share unused internet bandwidth and earn up to $20 for every 100GB shared.

- Fundrise: Invest in real estate with as little as $10 and earn dividends.

- Acorns: Automatically invest spare change from your purchases.

- Ibotta: Get cashback on groceries, travel, and online shopping.

- Airbnb: Rent out your property and earn an average of $14,000 annually.

- Robinhood: Build passive income through stock dividends and stock lending.

- Stash: Micro-invest in ETFs and stocks starting at $5.

- Betterment: Automated investing with tax-loss harvesting and rebalancing.

- Arrived: Invest in rental properties with fractional shares starting at $100.

- Dosh: Automatically earn cashback by linking your cards.

- InboxDollars: Get paid for surveys, reading emails, and more.

- Rakuten: Earn cashback from 3,500+ retailers.

- Google Opinion Rewards: Complete short surveys for Google Play credits or PayPal cash.

- Foap: Sell your smartphone photos to brands and earn $5 per sale.

- M1 Finance: Automate your investments with customizable portfolios.

- MyConstant: Peer-to-peer lending with returns up to 12% APR.

- HoneyBook: Manage client payments and workflows for service-based businesses.

- Nielsen Mobile Panel: Earn $60/year by sharing your internet usage data.

- Turo: Rent your car and earn up to $906/month.

Quick Comparison

| App | Primary Use | Earning Potential | Minimum Effort | Payout Method |

|---|---|---|---|---|

| Swagbucks | Surveys, shopping | $50–$200/month | Low | PayPal, gift cards |

| Honeygain | Bandwidth sharing | $20/100GB shared | Low | PayPal |

| Fundrise | Real estate investing | 8.5–12.5% annual returns | Medium | Dividends |

| Acorns | Spare change investing | Based on portfolio growth | Low | Investment returns |

| Ibotta | Cashback shopping | $261/year (avg) | Low | PayPal, gift cards |

| Airbnb | Property rental | $14,000/year (avg) | Medium to High | Direct deposit |

| Robinhood | Stock investments | Varies (dividends, APY) | Low | Bank transfer |

| Stash | Micro-investing | Varies (investment growth) | Low | Investment returns |

| Betterment | Automated investing | 8–12% annual returns | Low | Investment returns |

| Arrived | Rental properties | 3.2–7.2% annual returns | Low | Dividends |

| Dosh | Cashback | $25–$50/month | Low | PayPal, gift cards |

| InboxDollars | Online activities | $20–$40/month | Low | PayPal, gift cards |

| Rakuten | Cashback shopping | $90/year (avg) | Low | PayPal, checks |

| Google Rewards | Surveys | $0.10–$1 per survey | Low | Google Play, PayPal |

| Foap | Photo sales | $5/photo | Medium | PayPal |

| M1 Finance | Automated investing | Varies (portfolio growth) | Low | Investment returns |

| MyConstant | P2P lending | 4–12% APR | Medium | Bank transfer |

| HoneyBook | Business management | Varies (client payments) | Medium | Bank transfer |

| Nielsen Panel | Data sharing | $60/year | Low | PayPal, gift cards |

| Turo | Car rental | $906/month (avg) | Medium to High | Direct deposit |

These apps cater to different goals, from earning cashback to building wealth through investments. Start small, track your earnings, and diversify your efforts to maximize your passive income potential.

10 Best Passive Income Apps (100% Free & REALISTIC)

1. Swagbucks

Swagbucks is a rewards platform that pays users for everyday online activities. To date, it has handed out over $600 million in rewards through gift cards and PayPal. The system operates on a points-based model, where 100 Swagbucks (SB) equals $1.

Here’s how you can earn points:

| Activity Type | Typical Earnings | Time Investment |

|---|---|---|

| Online Shopping | 1–20% cashback | While shopping |

| Surveys | $0.04–$2.00 per survey | 5–20 minutes each |

| Special Offers | $0.02–$150 | Varies by offer |

Swagbucks also offers a browser extension called the SwagButton, which makes earning even easier. It automatically notifies you of cashback opportunities, discount codes, and coupons while you shop online.

"Swagbucks is the definition of 'easy money'. It doesn't promise to make you rich but, with very little effort, you can earn points on anything from watching videos to completing surveys."

– Owen Burek, Founder, Save the Student

Most users report earning between $50 and $200 a month. To get the most out of Swagbucks, consider these tips:

- Set Swagbucks as your default search engine to earn points with every search.

- Install the SwagButton extension for automatic rewards and shopping perks.

- Complete daily goals to unlock bonus points and streak rewards.

- Refer friends - you’ll earn 10% of their lifetime earnings.

Swagbucks offers flexible redemption options. You can cash out via PayPal or choose from a variety of gift cards. Many members redeem at least $22 monthly, often snagging discounted Amazon gift cards in the process.

For bigger payouts, focus on special offers. For instance, you can earn $125 in SB for a $25 deposit with Varo or $30 SB for a $10 deposit with Happy Nest.

The platform’s mobile app is also highly rated, with 4.5 stars on Google Play and 4.4 stars on the Apple App Store. If you’re looking for a simple way to turn everyday tasks into extra cash, Swagbucks is a great option to start with.

Up next, we’ll explore another platform that can boost your passive income opportunities.

2. Honeygain

Honeygain lets you earn passive income by sharing your unused internet bandwidth. The app works quietly in the background, paying you for the extra bandwidth that businesses use for data collection and market research.

Here’s a quick look at how you can earn:

| Activity | Earnings | Notes |

|---|---|---|

| Bandwidth Sharing | $0.20/GB | Main source of income |

| Content Delivery | Up to 144 credits/day | Extra earning option |

| Referral Program | $5 per friend | After your referral earns $20 |

| Daily Tasks | Up to 100,000 credits | Optional, for additional income |

To break it down, every 1MB of shared data earns 0.2 credits (each credit is worth $0.001). For example, sharing 100GB would earn you about $20.

"Partnering with Tipalti allows us to uphold this commitment by offering a more efficient and secure payout process, catering to our diverse user base around the globe." - Sandra Krikstaponyte, Product Owner at Honeygain

Tips to Maximize Earnings

- Run Honeygain on multiple devices.

- Use unlimited data plans.

- Enable the Content Delivery feature.

- Complete daily tasks to earn extra credits.

Honeygain prioritizes security by encrypting bandwidth and implementing strict Know Your Customer (KYC) standards. With a 4.5-star rating on TrustPilot, the app has a solid reputation for reliability.

Payments are processed through PayPal once you hit the $20 (20,000 credits) threshold. After submitting your payment details via Tipalti's Supplier Hub, you’ll usually receive your earnings within two business days.

New users get a $2 signup bonus, and round-the-clock help desk support is available if you need assistance. Compatible with Windows, macOS, Linux, and Android, Honeygain offers a simple way to earn money passively from your unused data.

3. Fundrise

Fundrise makes real estate investing more accessible, letting you start with as little as $10. With over $3.3 billion in assets under management and a community of more than 400,000 active investors, it’s a platform that’s gained significant traction.

How It Works

Fundrise pools investors’ money into diversified real estate portfolios through eREITs. These eREITs are required to distribute 90% of their taxable income as dividends, making them a reliable source of returns.

| Investment Plan | Focus | Annual Fee |

|---|---|---|

| Supplemental Income | Regular quarterly dividends | 0.85% |

| Long-Term Growth | Value appreciation | 0.85% |

| Balanced Investing | Mix of income and growth | 0.85% |

| Venture Capital | High-growth tech companies | 1.85% |

Over the past five years, Fundrise has delivered an average yield of 10.79%. To put that in perspective, this outpaces both the Vanguard Total Stock Market ETF (7.92%) and the Vanguard Real Estate ETF (7.4%).

Income Potential

- 4.81% over seven years

- 2024 Year-to-Date Return: 3.47%

- Typical annual returns range from 8.5% to 12.5%

"Fundrise makes it easy to become a real estate investor, but be prepared to do your own due diligence to make sure you understand each investment's risks and underlying costs." - NerdWallet

Key Features

- $10 minimum investment

- Quarterly dividends

- Professionally managed portfolios

- User-friendly mobile app

- A+ rating from the Better Business Bureau

Fundrise charges a 0.15% advisory fee, along with additional management fees depending on your chosen plan. Since real estate investments through Fundrise tend to be illiquid, it’s best for those with a long-term outlook, ideally five years or more.

For those looking for extra perks, Pro membership costs $10 per month or $99 per year and unlocks additional features and investment opportunities. If you’re planning for retirement, Fundrise offers IRAs with a $1,000 minimum. The $125 annual fee is waived if you invest $3,000 or more annually or maintain a balance above $25,000.

Next, we’ll dive into another app that can help you grow your passive income.

4. Acorns

Acorns simplifies investing by turning your everyday purchases into opportunities for growth through its Round-Ups® feature. With over $250 million invested just from spare change, this app has proven to be a reliable tool for generating passive income.

How It Works

Acorns rounds up your purchases to the nearest dollar and invests the spare change. For example, if you spend $3.75, the app rounds it up to $4.00 and invests the remaining $0.25. Once your Round-Ups® total $5, the funds are automatically invested into your selected portfolio.

| Plan | Monthly Fee | Features |

|---|---|---|

| Bronze | $3 | Includes Invest, Later, and Checking |

| Silver | $6 | All Bronze features + Premium Education, Emergency Fund, 4.05% APY on savings |

| Gold | $12 | All Silver features + Custom Portfolio and access to a Benefits Hub |

Investment Options

Acorns offers professionally crafted ETF portfolios from industry leaders like Vanguard and BlackRock. These portfolios are designed to diversify your investments across more than 7,000 stocks and bonds. You can choose between traditional Core portfolios or ESG portfolios, which focus on sustainable investing.

Income Potential

On average, users invest about $166 in the first four months. To maximize your returns, consider these tips:

- Link multiple cards to increase Round-Up contributions.

- Use the multiplier feature (2x, 3x, or even 10x) to grow your investments faster.

- Set up recurring investments alongside Round-Ups.

- Choose a more aggressive portfolio if you’re comfortable with higher risk, especially if you’re younger [38,39].

"We believe in beginnings, and the power of small steps. That's why we pioneered Round-Ups® investments. Now, it's easy to start investing, even with spare change." – Acorns

Fee Considerations

Acorns charges a flat monthly fee, and the percentage impact depends on your account balance:

| Account Balance | Bronze ($3/mo) | Silver ($6/mo) |

|---|---|---|

| $500 | 7.2% | 14.4% |

| $5,000 | 0.72% | 1.44% |

| $10,000 | 0.36% | 0.72% |

To keep fees under 1% annually, aim to maintain a higher account balance. For those on the Silver plan, the 4.05% APY on savings can help offset the added cost.

Additional Features

Acorns offers several tools to enhance your investing experience:

- Automatic portfolio rebalancing to keep your investments on track

- Custom portfolios (available with the Gold plan) that let you include individual stocks

- Expert-designed portfolios tailored to your goals

- Unlimited card linking for Round-Ups®

Acorns’ hands-off approach makes it an appealing choice for anyone looking to grow their wealth effortlessly. Up next, we’ll dive into another platform that can help you build your passive income stream.

5. Ibotta

Ibotta transforms everyday shopping into an opportunity to earn cashback. With over $2.3 billion paid out to users so far, it’s become a go-to app for savvy shoppers looking to save while they spend.

How It Works

Ibotta collaborates with more than 3,000 retailers to offer cashback on a variety of purchases, from groceries to travel bookings. You can earn cashback through three main methods:

| Shopping Method | How to Earn | Notable Partners |

|---|---|---|

| In-Store | Upload a photo of your receipt | Walmart, Target, Kroger |

| Online Shopping | Shop via the app or browser extension | Kohl’s, Ulta, Sam’s Club |

| Gift Cards | Buy gift cards through the app | Various major retailers |

These flexible options ensure there’s always a way to earn, no matter how or where you shop.

Earning Potential

On average, active Ibotta users make about $261 per year. Cashback earnings come from a mix of sources, including:

- Base cashback on purchases

- Bonus rewards for completing specific tasks

- Referral bonuses for inviting friends

- Special “any item” promotions that reward you for buying everyday essentials

Tips to Maximize Earnings

- Link your store loyalty cards to skip the hassle of uploading receipts manually.

- Check the app for available offers before you shop and use the barcode scanner to confirm product eligibility.

- Combine Ibotta cashback with store coupons, credit card rewards, and loyalty programs for bigger savings.

- Keep an eye on the bonus section in the app for extra earning opportunities.

“I use Ibotta sometimes if I want to give a bottle of wine as a gift since they have pretty good rebates on alcohol. I’ve also used it to get money back on hotel stays by booking through the app!”

- Team Clark member Beth

Real Results

Users have shared impressive success stories that show Ibotta’s potential:

- Michael Saves has earned $4,000 since May 2014 by focusing on strategic grocery shopping.

- The Money Ninja reported annual earnings of $751.40 by using Ibotta consistently.

Withdrawal Options

Once your cashback balance hits $20, you can cash out in several ways: transfer to PayPal, direct deposit to your bank, or convert your earnings into gift cards.

With these strategies, you can turn everyday shopping into a steady stream of extra income.

6. Airbnb

Turn your property into a steady source of income. On average, U.S. hosts earn around $14,000 annually through Airbnb.

How It Works

Airbnb provides a platform for property owners to rent out entire homes, spare rooms, or even unique spaces for short-term stays. The app handles payments, guest communication, and bookings, making it easier to manage the process.

| Aspect | Traditional Rental | Airbnb Short-Term |

|---|---|---|

| Monthly Income | Fixed rate | $4,300 average (2024) |

| Income Stability | Consistent | Seasonal fluctuation |

| Management Needs | Minimal | Moderate to high |

| Property Access | Limited | Flexible for personal use |

Making It Passive

To reduce hands-on involvement, you can:

- Automate check-ins using smart locks or keypads.

- Hire professional property managers to handle operations for about 15% of your monthly revenue.

- Use dynamic pricing tools that adjust rates based on demand and competition.

Earning Potential

The numbers show Airbnb's strong growth. By late 2023, active listings had increased 18% year-over-year, reaching 7.7 million. Additional insights include:

- Superhosts earn 64% more than regular hosts.

- U.S. hosts collectively earned $22 billion in 2022.

- Peak seasons can significantly boost your earnings.

Optimization Tips

Maximize your income with these strategies:

- Write detailed house manuals to minimize guest inquiries.

- Use professional photos to highlight your property.

- Enable instant booking for pre-screened guests.

- Regularly research the market to maintain competitive pricing.

- Offer high-quality amenities to justify premium rates.

Getting Started

Here’s how to prepare before listing your property:

- Review local short-term rental regulations.

- Secure any required permits and insurance.

- Use Airbnb's earnings calculator to estimate potential income.

- Set up automated cleaning and maintenance schedules.

- Build reliable systems for guest communication and support.

With the right setup, Airbnb can be a low-effort way to generate consistent returns, much like other passive income strategies.

7. Robinhood

Robinhood goes beyond just property rentals, offering tools designed to help users generate passive income through investments. As of March 2025, the platform boasts 25.6 million funded accounts and $187 billion in assets under custody. With its user-friendly approach, Robinhood provides several ways to build passive income streams.

Passive Income Features

Robinhood offers two account tiers - free and Robinhood Gold - and each comes with unique benefits for passive income opportunities:

| Income Source | Free Account | Robinhood Gold |

|---|---|---|

| Uninvested Cash APY | 0.01% | 4.00% |

| IRA Match | 1% | 3% |

| Stock Lending | Up to 15% | Up to 15% |

| Margin Interest-Free Balance | $0 | Up to $1,000 |

Investment Options

Robinhood's features make it easy to grow your investments without constant oversight. Key options include:

- Automatic dividend reinvestment: Reinvest dividends from stocks and ETFs automatically.

- Fractional shares: Start investing with as little as $1.

- 24/5 stock trading: Trade stocks almost any time the markets are open.

- Advanced desktop tools: Access detailed charting features to track performance.

These tools help ensure your earnings are reinvested efficiently, aligning with the goal of creating steady, passive income streams.

Platform Performance

Robinhood is known for its high execution standards, with 95.58% of orders completed at or better than the National Best Bid and Offer (NBBO).

"Robinhood is still a standout for easy signup and quick and streamlined mobile trade execution, the latter of which arguably has upsides and downsides. Buying and selling stocks is simple and intuitive and has few 'are you sure?' interruptions, which is great for beginners or trading on the go."

The platform’s Stock Lending program brought in $22 million in revenue in February 2025, marking a 69% year-over-year increase. Additionally, cash sweep balances - primarily from Gold members - reached $25.5 billion out of a $26.1 billion total, reflecting strong growth.

Optimization Strategies

To get the most out of Robinhood’s passive income tools:

- Consider upgrading to Robinhood Gold for $5/month to unlock higher APY and other perks.

- Enable automatic dividend reinvestment to keep your earnings working for you.

- Join the Stock Lending program to earn extra income from your portfolio.

- Keep uninvested cash in your account to take advantage of competitive APY rates.

- Use limit orders to potentially improve trade prices.

Security Measures

Protecting your account is essential to safeguarding your investments. Here are a few tips:

- Enable two-factor authentication for added security.

- Use strong, unique passwords to minimize risks.

- Verify website URLs to avoid phishing scams.

- Regularly monitor your account activity for any unusual behavior.

Robinhood combines accessibility with robust features, making it a solid choice for those looking to generate passive income through investments. By leveraging its tools and maintaining strong security practices, users can optimize their returns while keeping their assets safe.

8. Stash

Stash is a micro-investing platform that has helped its users save over $4 billion through passive income tools. Designed to simplify investing, it caters to both beginners and experienced investors. Let’s dive into Stash’s subscription tiers, automated income tools, and key features that make micro-investing more accessible.

Investment Options and Features

Stash offers two subscription plans, each with unique benefits for generating passive income:

| Feature | Growth ($3/month) | Stash+ ($9/month) |

|---|---|---|

| Smart Portfolio | ✓ | ✓ |

| Stock-Back® Rewards | 0.125% | 1% |

| Life Insurance | $1,000 | $10,000 |

| Kids Portfolios | Not available | Up to 2 |

| Market Insights | Basic | Advanced |

With the Smart Portfolio feature, Stash automatically manages your investments based on your risk tolerance. Starting is easy - just $5 is enough to get going. Plus, the platform keeps costs low with ETF expense ratios ranging from 0.06% to 0.08%.

Automated Income Tools

Stash provides several automated tools to maximize your passive income with minimal effort:

- Auto-Stash: Users who enable this feature typically grow their accounts by 40% more within the first year compared to those who don’t.

- Round-Up Investments: Spare change from everyday purchases is automatically invested.

- Fractional Shares: Invest in companies with as little as $5.

- Stock-Back® Card: Earn fractional shares as rewards for everyday spending.

Additionally, Stash’s Smart Portfolio automatically rebalances every quarter if your allocations stray more than 5% from your targets, ensuring your investments stay aligned with your goals.

Security and Requirements

To use Stash, you’ll need:

- A U.S. bank account

- A Social Security number

- U.S. citizenship, a Green Card, or an approved visa

The platform has empowered over 6 million people to build wealth, with users setting aside an average of $700. Stash combines accessibility with powerful tools to make investing simpler and more effective.

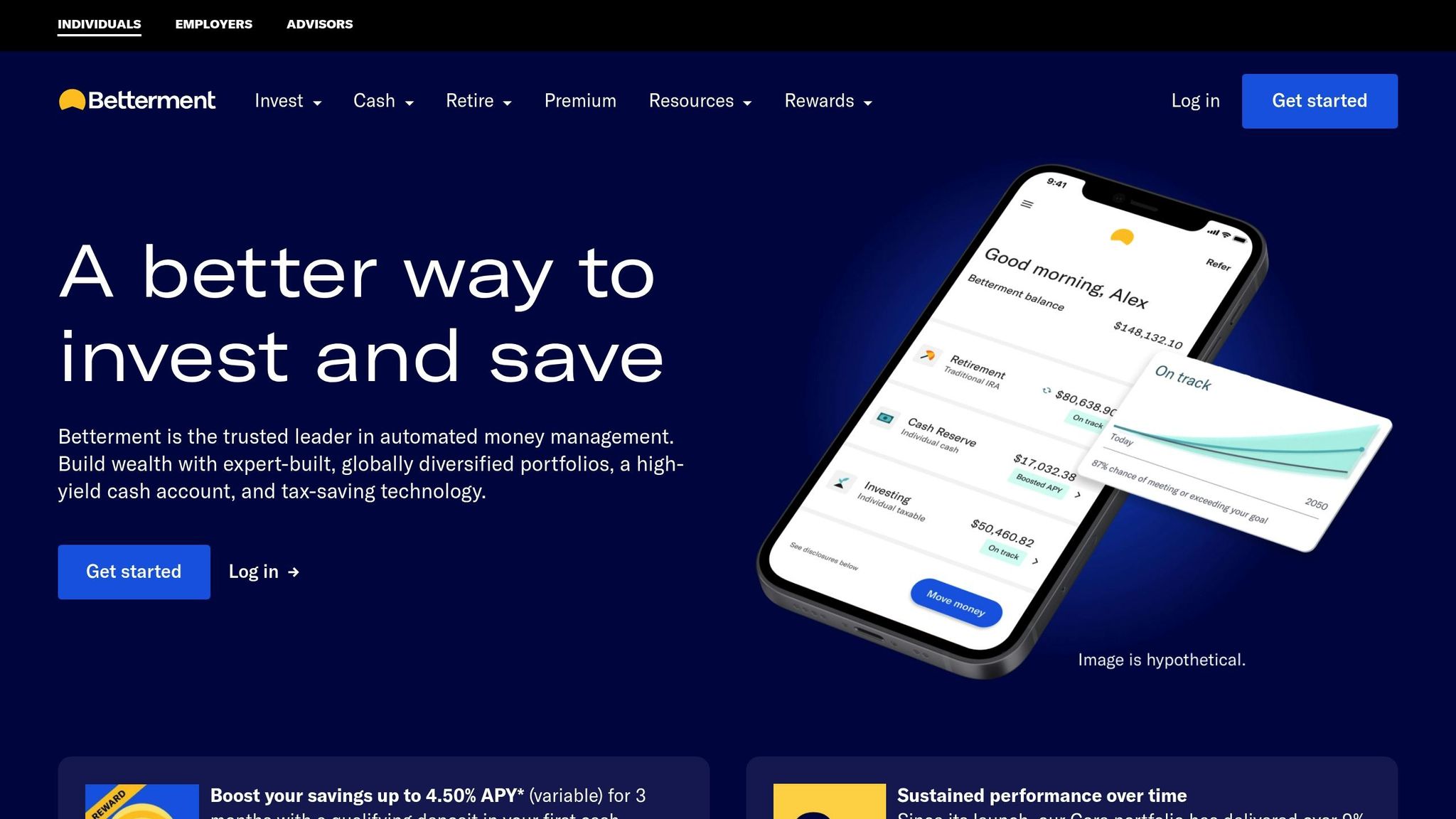

9. Betterment

Betterment is a well-known robo-advisor platform designed to help users generate passive income through automated investment management. With more than $50 billion in assets under management for 900,000 investors, it builds on the passive income strategies discussed earlier. Like other platforms in this guide, Betterment simplifies wealth creation by handling the complexities of investing for you.

Investment Options and Fees

Betterment offers two service tiers, each tailored to different needs and budgets:

| Feature | Digital | Premium |

|---|---|---|

| Annual Fee | 0.25% or $4/month | 0.65% |

| Minimum Balance | $0 | $100,000 |

| ETF Expense Ratios | 0.07% - 0.17% | 0.07% - 0.17% |

| Financial Advisor Access | Not included | Included |

| Portfolio Rebalancing | Yes | Yes |

| Tax-Loss Harvesting | Yes | Yes |

The Core portfolio has historically delivered annual returns exceeding 9% after fees. Additionally, tax-loss harvesting has covered advisory fees for nearly 70% of users.

Automated Features

Betterment's platform is packed with automated tools that make investing straightforward and efficient:

- Smart Portfolio Management: Investments are automatically selected and adjusted based on your financial goals and risk tolerance.

- Tax-Coordinated Portfolio: Assets are strategically allocated across taxable and tax-advantaged accounts to help reduce your tax burden.

- Automatic Rebalancing: Your portfolio is consistently realigned to match your target allocation without requiring manual input.

- Dividend Reinvestment: Dividends are automatically reinvested, helping to maximize the power of compounding.

"It's a good 'set-it-and-forget-it' investing tool for my family."

– Casey M., Non-paid client of Betterment

Performance and Results

Betterment's recent performance data highlights its potential for strong returns. For example, a 90% stock allocation in the Betterment Core portfolio achieved approximately 17.6% returns year-to-date through November 2024. Additionally, users who set up recurring deposits have experienced nearly 3% higher annual returns compared to those who don't.

The platform offers a variety of portfolio options to suit different investment interests:

- Core Portfolio: A traditional diversified investment strategy.

- Innovative Technology: Focused on growth in the tech sector.

- Socially Responsible: Prioritizing environmental and social governance factors.

- High-Yield Cash: Designed for effective cash management.

Betterment's automated system eliminates the guesswork from investing while delivering professional-level portfolio management. With its mobile app rated 4.8/5 on the App Store, you can easily track your investments anytime, anywhere. Up next, we’ll dive into another app that continues the trend of simplifying passive income strategies through automation.

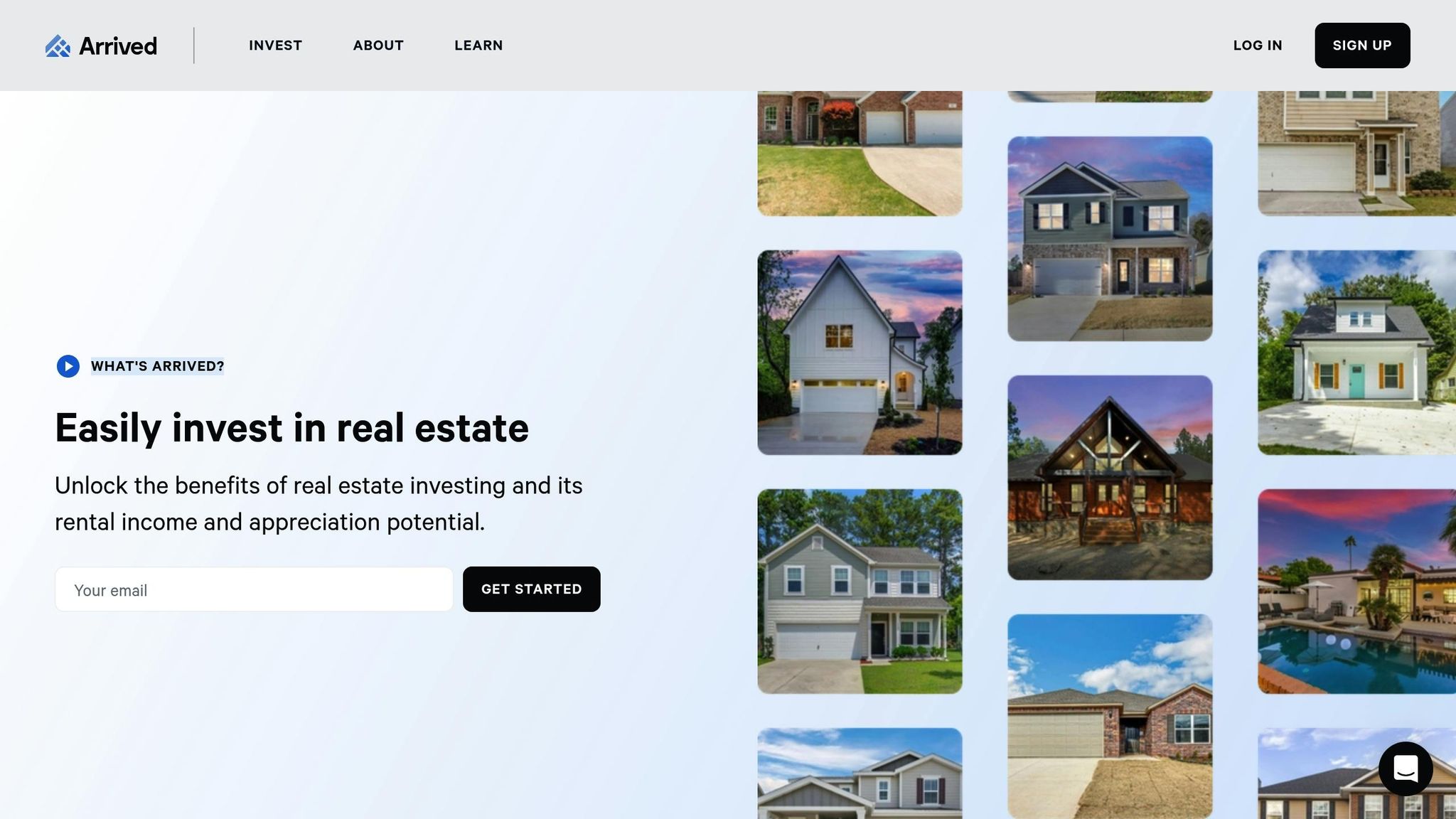

10. Arrived

Arrived is reshaping real estate investing by allowing individuals to invest in rental properties through fractional shares, starting with as little as $100. With $128 million in real estate assets spread across 361 properties, the platform offers a straightforward way to enter the market.

Investment Options and Returns

Arrived provides several investment categories, each with its own fee structure:

| Investment Type | Sourcing Fee | Management Fee | Property Management Fee |

|---|---|---|---|

| Long-Term Rentals | 3.5% | 0.15% quarterly | 8% of gross rents |

| Vacation Rentals | 5% | 5% of revenue | 15–25% of gross rents |

| Residential Fund | 3.5% | 0.25% quarterly | Included |

These fees support steady dividend payouts, with annual returns ranging from 3.2% to 7.2%. Additionally, 173 properties sold through the platform have delivered an average total return of 18.6% over a holding period of about 17 months. This strong performance is tied to Arrived's rigorous property selection process.

Property Selection Process

Arrived's approval process is highly selective, with only 0.2% of reviewed properties making the cut. This meticulous approach contributed to approximately $2.8 million in dividends distributed to investors in 2023.

Investment Strategy

Arrived relies on a data-driven approach to property selection and management, which has been key to its success. Each property is held within a limited liability company (LLC), ensuring investor liability is minimized. Investment terms typically range from 5–7 years for rental properties and 5–15 years for vacation rentals. Arrived handles all aspects of property management, making the process as seamless as possible for investors.

"Our goal is to make the wealth-building potential of owning rental homes more accessible. We believe we can do that by simplifying the process and lowering the cost to get started."

- Ryan Frazier, CEO and co-founder

Investor Transparency and Ratings

Arrived has earned an A rating from the Better Business Bureau and a 3.85/5 rating from Business Insider. With over $180 million in assets under management, the platform emphasizes transparency and accessibility. By combining a low barrier to entry, professional management, and a commitment to clear operations, Arrived stands out as a promising option for passive income through real estate investing.

11. Dosh

Dosh made earning cashback on everyday purchases effortless. Through partnerships with over 150,000 retailers, the app distributed more than $50 million in cashback to its users.

How Dosh Worked

Users simply linked their credit or debit cards, and Dosh automatically tracked purchases that qualified for cashback rewards [121, 123].

Cashback Breakdown

| Category | Cashback Rate | Processing Time |

|---|---|---|

| Retail Stores | Up to 10% | Up to 90 days |

| Restaurants | Varies by location | Up to 90 days |

| Hotel Bookings | Up to 40% | Up to 90 days |

Retail Partners

Dosh collaborated with some heavy-hitting brands like Walmart, Sephora, GNC, Finish Line, Disney+, Apple Music, and Pizza Hut. It also supported many local businesses, making it a versatile choice for cashback seekers [119, 121].

Security Features and User Eligibility

Dosh prioritized user security by using encryption to safeguard data. To use the app, users needed to meet a few criteria: they had to be at least 18 years old, reside in the U.S., and have a valid U.S.-based, non-VoIP mobile phone number.

"Dosh is a fun way to earn cashback rewards on top of what you already get from your credit or debit card. Linking your account gives you access to automatic cashback rewards. When you reach $25, you can cash out and use that money for whatever you want." - Eric Rosenberg, Freelance Contributor

Withdrawal Options

Once users accumulated $25 in their Dosh wallet, they could withdraw funds through direct bank deposit, PayPal, Venmo, or even donate the money to charity.

A Note on Discontinuation

Dosh ceased operations on February 28, 2025. Users with inactive accounts for over 12 months faced a $4.99 monthly service charge, which was deducted only from their Dosh wallet balance - not from linked cards [125, 127].

Though no longer active, Dosh showcased how automated cashback systems could simplify earning rewards, leaving a lasting mark on the passive income app landscape.

12. InboxDollars

InboxDollars is a platform where you can earn extra cash by completing various online activities. Since its launch in 2000, it has paid out more than $1.19 billion to its members, showcasing its reliability over the years.

Earning Opportunities

Here’s a breakdown of how you can earn with InboxDollars:

| Activity Type | Earning Potential | Time Investment |

|---|---|---|

| Paid Surveys | $0.50 - $5.00 | 3–25 minutes |

| Playing Games | Up to $310.10 | Varies by game |

| Reading Emails | $0.02 - $0.05 | 1–2 minutes |

| Cashback Shopping | Up to 5% | Regular shopping |

| Web Searching | $0.05 - $0.25 | Daily searches |

Payment Structure

InboxDollars keeps things simple with a $15 minimum withdrawal limit. You can choose to cash out via PayPal, gift cards, or prepaid Visa cards. Payments are processed every Wednesday, and funds typically arrive within 10 business days.

Success Stories

Sarah Houston, a nanny and student, shared her experience with InboxDollars:

"Once in a routine, earning extra money becomes mindless." Over three years, she earned $600 by consistently participating in surveys.

Tips to Maximize Earnings

- Fill out all profile surveys to unlock higher-paying opportunities.

- Try engaging in multiple activities at the same time.

- Check the platform daily for fresh offers.

- Use the InboxDollars search engine as your default homepage.

Recent Performance

InboxDollars has earned a TrustScore of 4.1, based on 47,262 user reviews. With regular use, many members report monthly earnings of $20 to $40.

"Even though InboxDollars doesn't pay huge amounts on its own, it's a solid get-paid-to (GPT) site, especially if you combine it with other similar sites and apps that allow you to make some extra pocket money quickly online or from your phone."

– FinanceBuzz

Security and Requirements

To use InboxDollars, you must be a U.S. resident with a valid PayPal account. Your account details - including name, mailing address, and email - must match the information on your InboxDollars profile. The platform prioritizes user privacy and data security, making it a trustworthy choice for those looking to earn a little extra income.

Next, we’ll dive into another platform to help expand your passive income options.

sbb-itb-fd652cc

13. Rakuten

Rakuten is a popular app for earning passive income, boasting over $3.6 billion paid in cashback to more than 20 million members. By partnering with 3,500+ retailers, Rakuten turns everyday shopping into cashback opportunities.

How It Works

Rakuten earns commissions from partnered stores when users shop through its platform. A portion of these commissions is shared with users as cashback, with the average member earning $90.16 per year.

| Shopping Method | Cashback Process | Payment Timeline |

|---|---|---|

| Online Shopping | Shop through Rakuten’s website | Quarterly via "Big Fat Check" |

| In-Store Shopping | Link your credit card & activate offers | PayPal payment option |

| Browser Extension | Automatic cashback activation | Same quarterly schedule |

Current Cashback Rates

Some retailers currently offering cashback through Rakuten include Bergdorf Goodman (up to 5%), NET-A-PORTER (2%), Nordstrom (2%), and Saks Fifth Avenue (2%). Shoppers can increase these earnings by using special promotions and strategies.

Maximizing Your Earnings

Rakuten provides several tools to help you get the most out of your shopping:

- Browser Extension: Add the Rakuten Cash Back Button to your browser, and it will automatically find and apply the best cashback offers.

- Mobile App Perks:

- Get geo-targeted push notifications for nearby deals.

- Activate in-store cashback offers right from your phone.

- Track your earnings on the go.

- Seasonal Promotions: Look out for Triple Cash Back events and check the Hot Deals section to maximize returns.

Bonus Features

Rakuten sweetens the deal with extra perks:

- Welcome Bonus: New users can earn 10% cashback on purchases during their first week, capped at $50.

- Referral Program: Invite friends to join, and earn bonuses when they make qualifying purchases.

- Rakuten Credit Card: Get an additional 3% cashback when you shop using the Rakuten credit card.

Security and Requirements

Rakuten is free to join and easy to use. To ensure you receive cashback:

- Log in to your account before shopping.

- Enable notifications for the browser extension.

- Link your credit cards for in-store purchases.

- Double-check cashback activation before completing transactions.

Rakuten doesn’t just cover retail shopping - it also offers cashback on hotel bookings, flights, and rental cars. Plus, members have the option to earn American Express Membership Rewards Points instead of traditional cashback.

14. Google Opinion Rewards

Google Opinion Rewards is a handy app that rewards you for completing quick surveys. With over 50 million downloads and availability in 39 countries, it’s a popular choice for earning small rewards in your spare time [151, 152].

How It Works

The app notifies you whenever a short survey is ready - most of them take just 10 seconds to complete. These surveys cover a variety of topics, such as:

- Feedback on recent shopping trips or visited locations

- Hotel reviews

- Merchant satisfaction surveys

- General opinion polls

Earning Potential

For each survey, you can earn between $0.10 and $1. If you’re using an Android device, your earnings come in the form of Google Play credits. For iOS users, payments are made via PayPal.

Tips to Maximize Earnings

- Enable Location Services: Turning on location tracking can increase the number of surveys you receive, as some are based on places you’ve recently visited.

- Be Consistent and Honest: Participating regularly and providing truthful answers can lead to more survey invitations over time [150, 154].

- Act Quickly: Surveys usually expire within 24 hours, so enable notifications and respond promptly to avoid missing out.

Important Notes

- You’ll need to accumulate at least $2 before you can redeem your rewards.

- Android users earn Google Play credits, while iOS users are paid through PayPal.

- Credits have a 12-month expiration date, so make sure to use them before they expire.

Usage Tips

Keep your profile updated with accurate demographic information to ensure you get surveys that match your profile. Honest and consistent responses are crucial - any inconsistencies could reduce the number of surveys you receive.

Stay tuned for more ways to earn passive income effortlessly through everyday activities!

15. Foap

Foap transforms your smartphone photos into a source of income, allowing you to sell them to brands and individuals. With over 4.5 million creators onboard and more than $3 million paid out over the last ten years, it’s become a go-to platform for aspiring photographers.

How It Works

Using the Foap app, available on iOS and Android, you can upload your photos and earn $5 per image sold (you receive a 50% commission on a $10 sale). Photos can be licensed in two ways:

- Commercial License: Ideal for advertising and marketing purposes.

- Editorial License: Used in blogs, magazines, and other non-commercial media.

Earning Potential

Each photo sale brings in $5, but you can earn more by participating in Foap Missions. These are contests where brands request specific types of photos. Mission rewards start at $50 and can go as high as $2,000.

Best-Selling Photo Types

To improve your chances of making a sale, focus on these kinds of photos:

- Everyday, authentic moments

- High-quality, well-lit images

- Sharp, clear compositions

- A variety of subjects

- Images that align with current trends

Optimizing Your Portfolio

Successful Foap creators often follow these tips:

- Strategic Tagging: Add 5–100 relevant keywords to make your photos easier to find [164, 165].

- Maintain Quality: Edit your photos lightly - enhance them subtly without overdoing filters.

- Stay Active: Regularly upload fresh content to keep your portfolio visible.

Getting Started

Setting up a Foap account is free. Here’s what you’ll need:

- A smartphone with the Foap app installed.

- A PayPal account to receive payments.

- Basic photo editing skills and an understanding of what sells in the market.

"With Foap, you're not just a creator, you're a potential brand ambassador. Build long-lasting relationships with brands, gain social proof, and skyrocket your career." – Foap

Platform Performance

User reviews reveal a mix of opinions about the platform:

| Platform | Rating | Number of Reviews |

|---|---|---|

| Apple App Store | 4.4/5 | 1,700 reviews |

| Google Play Store | 2.7/5 | 36,200 reviews |

| Trustpilot | 2.5/5 | 45 reviews |

16. M1 Finance

M1 Finance has reshaped passive investing with its unique "Pie" system, attracting over 1 million users and managing more than $8 billion in assets. This platform blends portfolio customization with automated management, making it a go-to choice for hands-off investors.

Core Features

At the heart of M1 Finance is its Pie-based portfolio system. Think of each "Pie" as your entire portfolio, divided into "slices" that represent individual investments. With access to over 6,000 securities, this setup makes asset allocation straightforward and easy to visualize.

| Feature | Benefit for Passive Income |

|---|---|

| Dynamic Rebalancing | Keeps your portfolio aligned automatically when funds are added |

| Smart Transfers | Moves cash seamlessly between savings and investments |

| Fractional Shares | Allows diversification even with small amounts of money |

| Dividend Tracking | Helps you stay on top of past and upcoming dividend payments |

Getting Started

Opening an account with M1 Finance is simple and requires minimal initial funding:

- Brokerage accounts: $100

- IRA accounts: $500

- Trust accounts: $5,000

While there’s a $3 monthly fee, it’s waived for accounts with balances of $10,000 or more. Plus, new users enjoy a 90-day fee-free period.

Automation Features

M1 Finance makes passive income generation even easier with its automation tools:

- Scheduled Investments: Set up recurring deposits weekly, bi-weekly, or monthly.

- Dynamic Cash Handling: Automatically directs new deposits based on your investment strategy.

- Portfolio Rebalancing: A single click ensures your portfolio stays aligned with your goals.

Investment Options

M1 Finance caters to a variety of investing preferences:

- Pre-built model portfolios for simplicity

- Custom portfolio creation for personalized control

- Access to both individual stocks and ETFs

- Options for Traditional, Roth, and SEP IRAs

"M1 Finance gives you a low-fee way to automate your investing using portions of pre-built portfolios called 'Pies.'" – Investopedia

Additional Benefits

Beyond its core features, M1 Finance offers several perks that enhance the investing experience:

- FDIC insurance up to $3.75 million on cash balances

- A high-yield Earn account with 4.00% interest

- Advanced 4096-bit encryption for added security

- No trading or commission fees

With its focus on automation, low costs, and user-friendly tools, M1 Finance is an excellent choice for anyone looking to grow wealth with minimal effort. Its streamlined approach and robust features make it a standout option among passive income platforms.

17. MyConstant

Launched in 2019, MyConstant is a U.S.-based peer-to-peer (P2P) lending platform that combines competitive interest rates with low entry barriers, allowing investments starting at just $10.

Investment Options

MyConstant offers a variety of investment tiers, each with its own return rates and minimum investment amounts:

| Investment Type | Return Rate | Minimum Investment |

|---|---|---|

| Basic Account | 4% APR | $10 |

| Direct Investment | Up to 7% APR | $50 |

| MCT Investment | 12% APR | $100 |

| Crypto Investment | 12.5% APY | $100 |

Key Features

This platform stands out with several unique features aimed at enhancing the user experience:

- Real-time interest calculation with compounding every second

- Multiple payment options, including ACH, Zelle, wire transfers, and gift cards

- Zero deposit fees for investors (note: crypto transactions may incur network fees)

- Collateral-backed loans, secured by cryptocurrency or tangible assets

While these features make MyConstant appealing, it's essential to consider the risks involved.

Important Risk Advisory

Higher returns often come with increased exposure to borrower risk.

"Investors who seek a greater return on their money from P2P platforms should make note that it only comes from the fact that they're sharing their funds with riskier borrowers. They have essentially taken on the risk that was formerly carried by banks and investment firms."

- Angelo DeCandia, professor of business at Touro University

Platform Performance

MyConstant has shown encouraging performance metrics, reflecting investor engagement and trust:

- Average portfolio size: $1,962

- Total claimed investor earnings: $2,323,393

- Trustpilot rating: 4.7/5 from over 1,500 reviews

Risk Management Guidelines

To navigate the risks, it’s crucial to diversify your investments, invest only what you can afford to lose, conduct thorough research, and stay updated on platform changes.

Cost Structure

Investors enjoy no deposit fees, and fiat withdrawals are free. Borrowers, however, pay a 3.5% fee on loans. For crypto withdrawals, network fees may apply.

MyConstant provides an approachable entry point into P2P lending, but investors should carefully balance the potential rewards with the associated risks.

18. HoneyBook

HoneyBook is a client management platform designed to simplify business operations and manage payments effortlessly, helping entrepreneurs create passive income streams. With over $12 billion processed through its payment system, HoneyBook enables business owners to scale efficiently.

Key Features for Passive Income Generation

| Feature | Benefit | Impact |

|---|---|---|

| Client Portal | Centralized access to files and payments | Minimizes back-and-forth communication |

| Payment Processing | Supports ACH and credit card payments | Speeds up payment collection |

| Workflow Automation | Automates client onboarding processes | Doubles client booking speed |

| Template System | Customizable business documents | Saves time on repetitive tasks |

Performance Metrics

HoneyBook delivers impressive results for its users:

- 95% of members report improved organization

- 2x increase in new client bookings through integrations

- 98% of members would recommend HoneyBook to others

Pricing Structure

HoneyBook provides three pricing options, all billed annually:

- Starter: $29/month

- Essentials: $49/month

- Premium: $109/month

Each plan includes a 7-day free trial, allowing users to explore the platform risk-free.

Real User Success

"HoneyBook makes my client experience look and feel professional... I love having all my emails, scheduling, legal docs, and project details in one easy-to-use place!" - Danielle J., Business Consultant

This testimonial highlights HoneyBook's ability to enhance professionalism and streamline operations for its users.

Automation Benefits

HoneyBook’s automation tools offer several advantages:

- Cuts down on administrative tasks with automated payment reminders

- Simplifies client onboarding with integrated proposal, contract, and invoice workflows

- Improves cash flow management with efficient payment tracking

- Supports business growth without requiring additional time investment

Platform Integration

HoneyBook works seamlessly with popular tools like:

- QuickBooks Online

- Gmail

- Google Calendar

- Zoom

- Zapier

Additionally, its iOS and Android apps ensure you can manage your business while on the move.

Industry Applications

Initially tailored for the events industry, HoneyBook has expanded to support a wide range of professionals, including:

- Digital marketing strategists

- Business consultants

- Creative professionals

- Freelancers

- Small business owners

These features and integrations make HoneyBook a powerful tool for service-based entrepreneurs looking to streamline their operations and build reliable passive income streams.

19. Nielsen Mobile Panel

The Nielsen Mobile Panel provides a simple way to earn rewards by letting the app anonymously track your internet usage. Once installed, it works quietly in the background, gathering data about your browsing habits. In return, you earn points that can be redeemed for cash via PayPal or gift cards.

Earning Potential and Rewards

Participants can earn up to $60 in rewards annually, plus enjoy the chance to win monthly sweepstakes with a top prize of $500. Nielsen also offers occasional special surveys, giving users opportunities to earn even more. All points can be exchanged for PayPal cash or gift cards.

How It Works

The app collects anonymous information about your online behavior, such as the websites you visit, how much time you spend online, which apps you use, and your overall device activity [197, 199].

"The app is easy to install, won't slow down your devices and sends us anonymous data about how you use the internet. Our app never collects the content of visited websites, and we do NOT collect user IDs, passwords or other private information." – Nielsen

Security and Privacy Features

Nielsen takes privacy seriously, implementing several measures to ensure your data stays protected:

| Security Measure | Implementation | Benefit |

|---|---|---|

| Data Protection | Technical and organizational safeguards | Keeps user information secure |

| Anonymous Collection | No personal identifiers are gathered | Protects your identity |

| Transparent Processing | Clear data usage policies | Builds user trust |

| Compliance | Adherence to U.S. privacy laws | Provides legal assurance |

Requirements to Join

To become a member of the Nielsen Mobile Panel, you’ll need to meet the following criteria:

- Be at least 18 years old

- Own a supported device

- Have the legal authority to install the app

- Notify and get consent from others who use your devices

Installation Process

Getting started with Nielsen Mobile Panel is straightforward:

- Sign up on the official Nielsen Computer & Mobile Panel website.

- Download the Nielsen app.

- Install the app on your eligible devices.

- Use your devices as you normally would.

Professional Impact

Nielsen’s research plays a key role in shaping market trends and improving online services. As ConsumerSearch.com puts it:

"If you prefer effortless earnings while helping shape market research trends anonymously, then this app might just be right up your alley".

Using advanced tools and stringent privacy standards, Nielsen ensures that individual user data remains anonymous and unidentifiable in reports shared with clients.

20. Turo

Turo is a platform that transforms your parked car into a money-making asset. By renting out your vehicle when it’s not in use, you can generate a steady stream of income with minimal effort.

Earning Potential

Here’s what you could earn by listing your car on Turo:

| Hosting Type | Average Monthly Earnings | Annual Potential |

|---|---|---|

| Single Car | $906 | $10,872 |

| Three Cars | $2,330 | $27,960 |

| Passive Hosting | $634 (70% of earnings) | $7,608 |

If you’re interested in a hands-off approach, Turo’s passive hosting option takes care of most of the work for you.

How Passive Hosting Works

With passive hosting, you don’t need to worry about the day-to-day tasks of renting out your car. A vetted All-Star Host handles everything, including:

- Communicating with renters and coordinating bookings

- Cleaning and maintaining your car

- Managing delivery and pickup logistics

"Brendon fully takes care of our vehicle and all of the operational side of things. It offers a completely hands-off experience." - Kelly, Tesla Model X owner, who earned $907 in January 2024 through passive hosting

Vehicle Requirements

To list your car on Turo, it must meet the following criteria:

- Be under 12 years old (exceptions apply for classic cars)

- Have fewer than 130,000 miles

- Possess a clean title and a working odometer

- Be worth less than $200,000

- Have valid registration and insurance

Protection Plans and Earnings

Turo offers several protection plans, which affect your earnings and the level of coverage:

| Protection Level | Host Earnings | Coverage |

|---|---|---|

| Basic | 85% of trip price | Minimum coverage |

| Standard | 75% of trip price | Enhanced protection |

| Premium | 60% of trip price | Maximum coverage |

| Passive Hosting | 70% of trip price | Managed by host |

Success Story

Take Phoenix-based host Camesha Whitmore, for example. She earned an impressive $76,620 in 2022 by managing seven cars on Turo.

Tips to Maximize Earnings

Want to get the most out of Turo? Follow these tips:

- Research local demand: Understand what types of cars are popular in your area.

- Set competitive rates: Price your rentals to match market conditions.

- Keep your car in top shape: Regular maintenance ensures satisfied renters.

- Use professional photos: High-quality images attract more bookings.

- Offer excellent service: Prompt communication and reliability go a long way.

"I like that I am able to help her and her husband find success on Turo in a busy market that is stress-free for them." - Brendon, All-Star Host since 2019

Turo’s user-friendly system, comprehensive insurance options, and flexible hosting plans make it a compelling choice for anyone looking to turn their car into a passive income source.

How to Get Better Results

Once you’ve explored a variety of passive income apps, it’s time to fine-tune your strategy. Here’s how you can take your results to the next level.

Smart Income Tracking

Set up a reliable system to monitor your earnings across all apps. Tools like Mint and Personal Capital can help you consolidate your income streams and provide real-time updates on your finances.

Tax Management Strategy

Understanding tax obligations is crucial to protecting and maximizing your passive income. For example, here are the 2025 capital gains tax rates for single filers:

| Income Level (Single Filers) | Short-Term Rate | Long-Term Rate |

|---|---|---|

| Up to $11,925 | 10% | 0% |

| $11,926 – $48,475 | 12% | 0% |

| $48,476 – $103,350 | 22% | 15% |

| $103,351 – $197,300 | 24% | 15% |

| $197,301 – $250,525 | 32% | 15% |

| $250,526 – $626,350 | 35% | 15% |

| Over $626,350 | 37% | 20% |

Keep detailed records of your earnings and any related expenses. This will not only help with tax filing but also give you a clear picture of your net income.

Optimization Techniques

Carve out specific time slots to manage your apps and make use of automation tools whenever possible to save time. This can help streamline your efforts and keep things running smoothly.

"People often underestimate the initial costs of a passive income opportunity and as a consequence may not have adequate liquidity." - Marguerita Cheng, CEO of Blue Ocean Global Wealth

Performance Monitoring

Regularly evaluate the performance of each app by analyzing metrics like monthly revenue, time spent, return on investment (ROI), and overall reliability. This will help you identify which apps are worth your time and effort.

Risk Management

Diversifying your income streams is key to minimizing risk. Spread your efforts across various platforms, such as investment apps, rental income tools, cashback services, and survey/reward programs. This approach ensures that you’re not overly reliant on a single source of income.

"Be positive and optimistic while being pragmatic. You can build upon your success." - Marguerita Cheng, CEO of Blue Ocean Global Wealth

Scaling Strategy

Once you’ve identified high-performing apps, consider gradually increasing your investments in them. Use portfolio management tools to track their performance and allocate more resources to the apps that deliver the best returns on your time and money. By focusing on what works, you can scale your passive income efficiently.

Future of Passive Income Apps

The landscape of passive income apps is evolving rapidly, driven by advancements in technology and innovative revenue models. By 2030, the AI market is expected to hit a staggering $826.7 billion, opening up exciting possibilities for passive income seekers. Let’s dive into how AI and emerging trends are reshaping the way people generate income.

AI-Powered Evolution

Artificial intelligence is transforming passive income opportunities by automating tasks and improving efficiency. In 2024, a remarkable 95% of marketers reported positive revenue results from integrating AI into their strategies. Here’s how AI is making waves:

- Content Automation: AI tools can create content and provide personalized recommendations to maximize earnings.

- Smarter Market Insights: Advanced algorithms help users make better investment decisions.

- Operational Efficiency: Automation reduces manual work, allowing for smoother income generation.

Emerging Revenue Streams

Passive income is no longer limited to traditional methods. New avenues are emerging, offering fresh ways to earn:

- Green Energy Investments: Leasing opportunities in solar and wind energy are becoming increasingly popular.

- The Creator Economy: Digital creators can now monetize their skills and assets in innovative ways, from selling digital products to earning passive royalties.

Market Transformation

The passive income market is undergoing significant changes, creating new opportunities for individuals and businesses alike. Here’s a snapshot of key trends:

| Trend | Impact | Opportunity |

|---|---|---|

| Micro-Investing | Easier market entry | Build portfolios with minimal upfront capital |

| Real Estate Access | Broader participation | Invest in property with lower financial barriers |

| AI Integration | Streamlined processes | Leverage smart tools for automated income |

| Creator Economy | Wider earning potential | Monetize digital products and skills |

Adaptation Strategies

To thrive in this rapidly changing environment, consider these strategies:

1. Develop New Skills: Learn AI, digital marketing, and content creation to stay ahead in the game.

2. Embrace Technology: Use automation tools and platforms to simplify income-generating activities.

3. Stay Informed: Keep an eye on market trends and technological advancements. For example, the freelance economy is projected to grow to 86.5 million workers in the U.S. by 2027.

Risk Management in a Changing Landscape

As passive income apps become more advanced, it’s essential to manage risks effectively. Focus on:

- Diversifying Investments: Spread your assets across various platforms to minimize risk.

- Platform Security: Prioritize apps and tools with strong security measures.

- Monitoring Performance: Regularly track your returns and market trends.

- Regulatory Awareness: Stay updated on financial regulations to ensure compliance.

The future of passive income apps holds immense promise, offering more accessible and diverse options for earning. By adapting to technological shifts and adopting a balanced approach, you can unlock new opportunities in this dynamic space.

Conclusion

Building financial stability through passive income apps is all about finding the right mix. By balancing low-effort returns with a variety of income streams, you can create a more reliable and lasting financial foundation. Here’s how to make the most of the strategies and insights shared earlier.

Smart App Selection Strategy

Choosing the right apps is key. Experimenting with different platforms can help you discover which ones fit your lifestyle and financial goals. Some apps are virtually hands-off, while others may need more of your time and attention.

| Income Strategy | Benefits | Things to Keep in Mind |

|---|---|---|

| Focus on One App | Easier to manage and master | Higher risk if that app underperforms |

| Use Multiple Apps | Diversifies income, lowering overall risk | More setup and management required |

| Combine Approaches | Balances risks and rewards, with room to scale | Requires ongoing monitoring and adjustments |

Tips to Maximize Results

Here are some practical ways to get the most out of your passive income efforts:

- Start Small: Focus on mastering one app before adding more to your portfolio. This prevents overwhelm and sets a strong foundation.

- Track Your Earnings: Keep an eye on your performance and adjust your strategy as needed. Small tweaks can lead to better results.

- Be Adaptable: If one app isn’t delivering, don’t hesitate to shift your focus to better-performing options.

- Reinvest Earnings: Use your profits to explore new opportunities or scale existing ones.

As passive income apps continue to evolve, they’re offering more advanced tools and opportunities to help you earn extra money. By staying flexible, diversifying your efforts, and consistently refining your approach, you can create a steady, growing stream of passive income over time.

FAQs

How do apps like Swagbucks and Honeygain protect your privacy and secure your data?

How Do Swagbucks and Honeygain Handle Your Data?

When it comes to user privacy and data security, apps like Swagbucks and Honeygain don’t cut corners. They’ve put measures in place to ensure your information stays safe and your trust is well-placed.

Swagbucks, for instance, uses encryption to protect your data while it’s being transmitted. They’re also upfront about how they collect, use, and share your information. With clear policies on data retention and third-party sharing, they make sure you’re always in the loop about where your data goes and why.

Honeygain takes a similar approach by collecting only the personal information that’s absolutely necessary. They also encrypt your internet activity to keep it secure and carefully vet their partners to ensure everything operates smoothly and safely. On top of that, both apps are committed to keeping their privacy practices transparent, so you can feel confident while earning passive income.

What should I look for in a passive income app to earn money with minimal effort?

When choosing a passive income app, it's important to focus on a few key elements to make sure you can earn efficiently with minimal hassle:

- Ease of Use: Pick apps that are straightforward to set up and require little effort to maintain. A simple, user-friendly design can save you time and make the experience more enjoyable.

- Earning Potential: Evaluate how much you can realistically earn based on the app’s payout system and the types of activities it rewards, like shopping, browsing, or completing small tasks.

- Reputation and Reliability: Stick with apps that have solid reviews and a strong track record. This ensures they’re dependable and known for providing consistent payouts.

By keeping these factors in mind, you’ll be better equipped to find an app that aligns with your goals and helps you build passive income with minimal effort.

What’s the best way to track and manage earnings from multiple passive income apps?

To keep tabs on your earnings from multiple passive income apps, start with a straightforward spreadsheet. Add essential details like the app's name, the income amount, how often payments come in, and the dates. This simple setup helps you see all your income streams at a glance and identify patterns over time.

If you'd rather automate the process, tools like Mint or Quicken can be game-changers. These apps sync directly with your financial accounts, offering real-time updates and insights into your income. There are also apps specifically designed for tracking passive income, which often come with handy features like detailed earnings reports and progress tracking toward your financial goals.

Using a mix of these methods keeps things organized, helps you track your growth, and ensures you're making smart choices about your finances.